Where The Needs Of Others Come First · Available 24x7 For Emergencies

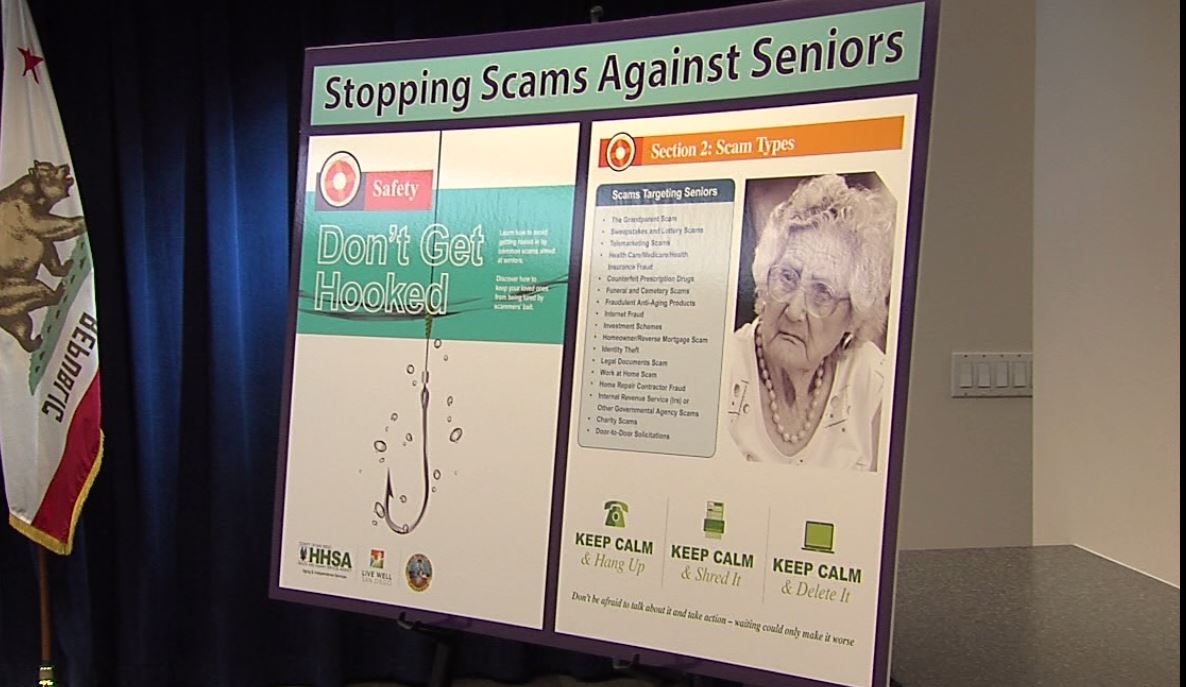

How to Avoid Scams that Target Senior Citizens

Because of their perceived vulnerability, seniors are often the target of online, phone, and other types of scams. These scams have the potential to cost thousands of dollars, ruin credit scores, and destroy the wealth that seniors have spent their lives building. In order to avoid these scams, there are a few simple steps that can be taken to minimize your risk of having your identity stolen or falling prey to a similar plan. By avoiding scams that prey on the elderly, you can make sure your hard earned money is protected, and that you’ll be able to enjoy the golden years of your life.

Know Common Tactics that Draw in Seniors

The most important way to prevent scam artists is to get inside their head and understand how they think. By learning common tactics that they use, seniors can be ready when the situation arises, and they can protect themselves. Some things that scammers often do to prey on seniors are pose as a family member and ask for money for medical or legal help, impersonate a government or bank and claim that you owe backed taxes, legal fees, unpaid tickets, etc., claim you owe on your utilities or they will be shut off, and the most famous one is the “Nigerian Prince” scam, where someone posing as foreign royalty requests a relatively small sum of money, with the promise that they’ll pay back with an unusually high bonus for helping them out. By knowing what to expect, seniors are more likely to avoid these scams and protect their assets.

Avoid Giving Personal Information over the Phone

As part of these scams, the caller or emailer will often phish for personal information in order to steal your identity. In order to avoid identity theft, don’t give any information out over the phone or online that you wouldn’t give out to a stranger, especially when you don’t know who is calling. Important information that scam artists can use include credit card numbers, social security numbers, official identification numbers, personal family history, banking information, or any information that you have used as security questions for personal accounts. This information can all be used to steal account information, and ultimately siphon money out of your personal accounts, so it should be protected the same way you protect your money and your account login information.

Ask Questions when you’re Skeptical

If you are ever skeptical when having a conversation with someone that is claiming to be an employee of a business that you work with, confirm what they’re saying by hanging up and calling that company directly. Skepticism with personal information is not a bad thing, so whenever you get an unsolicited call you should verify that what the caller is saying is true by calling the company’s customer service number to take care of any issues with your account. Most businesses and banks have policies against asking for personal information over the phone or email, so anytime this is asked for, make sure that it is genuinely needed and that it’s going to the correct party.

Identity thieves are becoming more tech savvy and smarter about scamming seniors, but with these tips, you can stay one step ahead of the criminals and protect yourself. By learning more about the motives and tactics that scammers are using, avoiding providing personal information over the phone, and having some skepticism when they face unsolicited phone calls, seniors can minimize their susceptibility to scams that prey on the elderly. With these simple steps, seniors can start avoiding scams that prey on the elderly and protect their family’s personal security and their hard-earned money.